Huntington’s Disease: Charting a New Path with Disease-Modifying Therapies and Strategic Innovation

The Huntington’s disease treatment market is evolving, with novel therapies targeting mHTT and reshaping the future of neurodegeneration.

AUSTIN, TX, UNITED STATES, June 6, 2025 /EINPresswire.com/ -- Disease Overview

Huntington's disease (HD) is a fatal, inherited neurodegenerative disorder caused by mutations in the HTT gene, leading to the production of mutant huntingtin protein (mHTT). This toxic protein progressively damages neurons, particularly in regions controlling movement, cognition, and behavior. Symptoms usually begin between ages 30 and 50 and worsen over 10–20 years. Core clinical features include involuntary jerky movements (chorea), impaired coordination, personality changes, depression, and cognitive decline. Over time, affected individuals become dependent on caregivers and ultimately succumb to complications such as pneumonia, heart failure, or malnutrition.

Download Free CI Sample Report: https://www.datamintelligence.com/strategic-insights/sample/huntingtons-disease-pipeline-momentum-biotech-next-frontier

Epidemiology Insights (Current & Forecast)

Huntington’s disease affects an estimated 5 to 10 per 100,000 people in most Western countries, with variation by region and ethnicity. Prevalence is higher in populations of European descent and considerably lower in Asian and African populations. As genetic testing becomes more accessible and disease awareness improves, diagnosis rates are expected to rise. Additionally, earlier genetic confirmation—even in pre-symptomatic individuals—has led to a redefinition of the therapeutic window, expanding the treatable population over time.

Current Approved Therapies – Market Status

As of 2025, the treatment landscape remains largely dominated by symptomatic therapies aimed at chorea management. These include:

- Xenazine® (tetrabenazine): The first FDA-approved treatment for HD-related chorea. Though effective in reducing movements, its patent has expired, and its market share has declined due to newer alternatives.

- AUSTEDO® XR (deutetrabenazine): Teva Pharmaceuticals’ extended-release formulation is currently the market leader, offering once-daily dosing and fewer side effects compared to Xenazine. It showed a 4.4-point improvement in Total Maximal Chorea (TMC) scores.

- INGREZZA® (valbenazine): Marketed by Neurocrine Biosciences, it demonstrated a 4.6-point TMC score improvement and is gaining traction, particularly for patients with comorbid tardive dyskinesia.

These therapies primarily modulate dopamine release in the brain, providing symptomatic relief but without any disease-modifying effect. Their market success has been driven by oral administration, ease of use, and demonstrated efficacy in movement symptom control.

Pipeline Analysis and Emerging Innovations

The pipeline for Huntington’s disease is advancing rapidly, with a clear shift toward disease-modifying therapies that aim to slow or halt the progression by targeting the genetic and molecular root of the disease. Several investigational agents are targeting the mutant huntingtin (mHTT) protein via mechanisms like:

- Antisense oligonucleotides (ASOs)

- RNA interference (RNAi)

- Gene-editing (CRISPR/Cas9) approaches

- Protein degradation and clearance pathways

- Neuroinflammation modulation and neuroprotection

Leading candidates are in Phase II and III trials, and the FDA has granted Fast Track or Orphan Drug Designations to multiple programs. If successful, these therapies could enter the market between 2026 and 2029, redefining treatment paradigms.

Competitive Landscape and Market Positioning

The competitive environment is shaped by both legacy players and emerging innovators:

- Teva Pharmaceuticals holds dominance with AUSTEDO XR.

- Neurocrine Biosciences is strengthening its neurological franchise with INGREZZA.

- Wave Life Sciences, Roche/Genentech, UniQure, and Sage Therapeutics are at the forefront of the disease-modifying pipeline, leveraging RNA-targeting, gene therapy, and neuroprotective approaches.

- Novartis and Ionis Pharmaceuticals are also building strong HD pipelines with ASO platforms.

The key differentiators going forward will be mechanism of action, duration of effect, clinical meaningfulness, and safety profile. In a landscape where symptomatic treatments have plateaued, new players must demonstrate a superior value proposition.

Target Opportunity Profile (TOP): Strategic Priorities for Next-Gen Therapies

Emerging therapies in Huntington’s disease must go beyond current symptomatic options to win in this space. The ideal treatment profile is being defined by clear expectations in efficacy, safety, patient convenience, and long-term benefit.

From a mechanistic perspective, new therapies must target the fundamental pathology—mutant huntingtin protein. Therapies that silence or degrade mHTT, or correct the underlying genetic mutation, will have the highest potential to alter disease course. Merely suppressing symptoms is no longer sufficient for competitive positioning.

In terms of safety, current oral therapies are generally well tolerated, so any new therapy must match or exceed this standard. Especially for approaches requiring intrathecal or intracranial administration—such as ASOs or gene therapies—risk-benefit ratios must strongly favor benefit, with minimal CNS toxicity or long-term complications.

Efficacy will remain the strongest driver of market adoption. New entrants must prove a clinically meaningful slowing or halting of disease progression, with measurable improvements across motor, cognitive, and psychiatric domains. Biomarker validation—such as reduced mHTT or neurofilament light chain (NfL)—is increasingly essential to support clinical findings and regulatory approvals.

Ease of use is another key factor. While oral therapies are convenient, newer treatments administered less frequently—monthly infusions or single-dose gene therapies—could gain traction if they offer sustained benefits. Avoiding burdensome administration schedules will be especially critical for a progressively disabled population.

On the clinical trial front, robust data is essential. Therapies must demonstrate statistically and clinically significant outcomes in HD rating scales like UHDRS and correlate biomarker changes with clinical outcomes. Trials should be inclusive across age, symptom severity, and geographic regions, with long-term follow-up (at least 12 months) to support durability of benefit.

Importantly, early diagnosis and intervention will likely play a pivotal role in future success. Stratification based on genetic testing, biomarker levels, and imaging may enable earlier treatment before irreversible neuronal loss occurs. Therapies that demonstrate value even in the pre-symptomatic or early-stage population could become the gold standard.

Lastly, pricing and reimbursement strategy will shape commercial success. Although orphan pricing is accepted in rare diseases, payers will expect clear differentiation and real-world value. Market access efforts must begin early, with health economics and outcomes research (HEOR) data supporting payer negotiations.

Book Your Free CI Consultation Call: https://www.datamintelligence.com/strategic-insights/ci/huntingtons-disease-pipeline-momentum-biotech-next-frontier

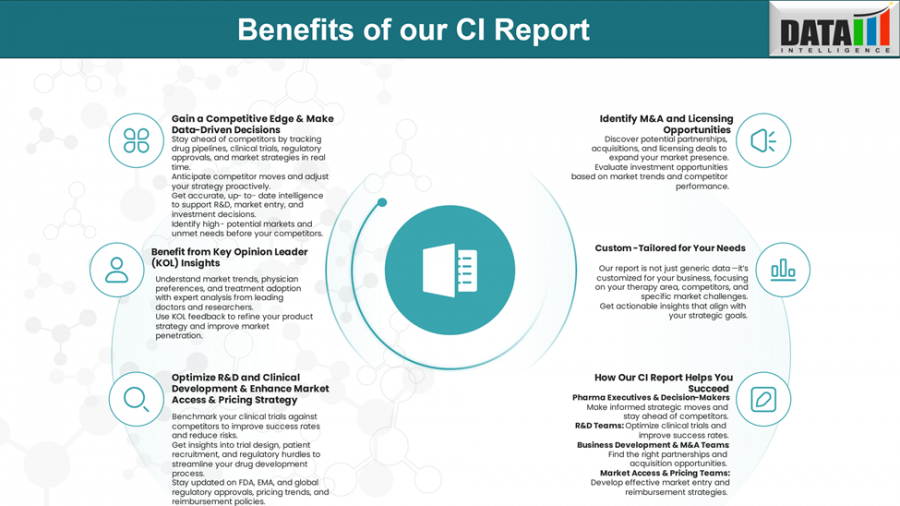

Why Choose Our Huntington’s Disease Competitive Intelligence Report?

Our Pharma CI Report offers a strategic 360-degree view of the Huntington's disease market—ideal for R&D teams, business development, strategy heads, and investors.

- Anticipate competitor moves and design smarter, faster go-to-market strategies.

- Track emerging trends in real-time—regulatory designations, late-stage trials, licensing activity.

- Leverage KOL feedback to align your product design with clinical realities.

- Benchmark your clinical programs against global peers and minimize development risk.

- Identify potential licensing and M&A targets in the fast-evolving HD space.

Customize intelligence to your specific asset or competitor focus, including pricing, adoption barriers, and trial performance.

Read Our Related CI Reports:

1. Lupus Nephritis | Competitive Intelligence

2. Immune Thrombocytopenia (ITP) |Competitive Intelligence

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release